Understanding Exness Trading Instruments A Comprehensive Guide

Understanding Exness Trading Instruments

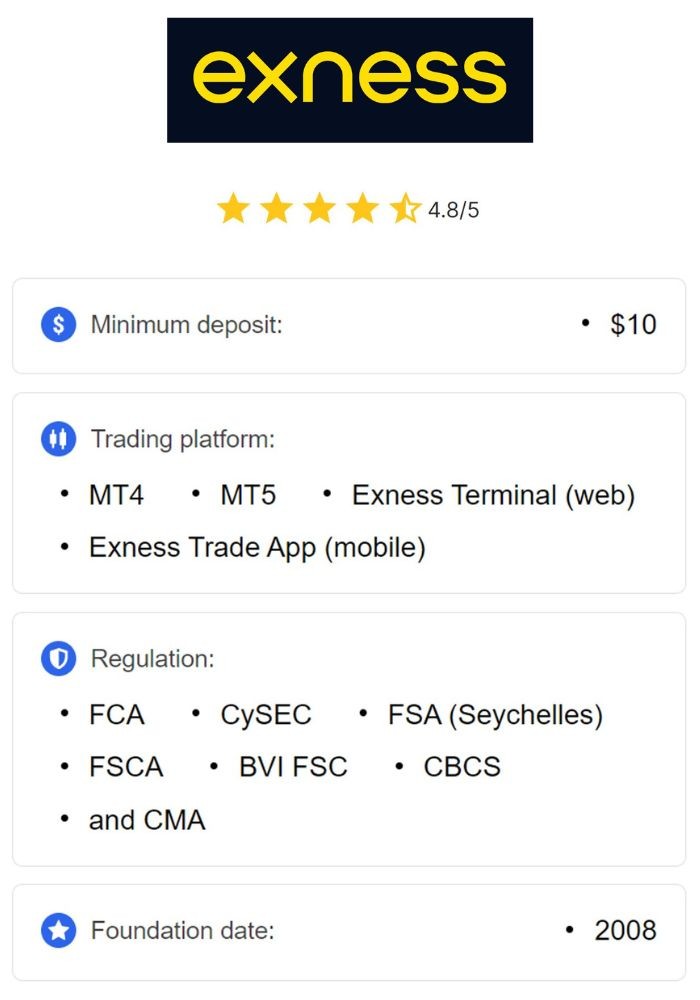

In the ever-evolving world of trading, understanding the instruments available to you is crucial for executing successful strategies. Exness stands out as a reputable broker, offering a wide range of trading instruments that cater to the needs of diverse traders. In this article, we will delve into the depths of Exness trading instruments, discussing various asset classes including forex, commodities, indices, and cryptocurrencies. Moreover, we will provide insights on how to effectively leverage these instruments to maximize your trading potential. For detailed trading guidance, you can visit Exness Trading Instruments https://nextradeplus.com/vi/.

1. Forex Trading Instruments

Forex trading remains one of the most popular ways for traders to gain exposure to the financial markets. Exness offers a vast array of currency pairs for trading, allowing traders to capitalize on the price movements of various currencies. From major pairs like EUR/USD and GBP/USD to exotic pairs such as USD/SGD, Exness ensures that traders have access to the most liquid and volatile currency markets.

1.1 Major, Minor, and Exotic Pairs

Exness categorizes its forex pairs into three primary types: major, minor, and exotic. Major pairs include the most commonly traded currencies, while minor pairs consist of less frequently traded currencies that often offer higher volatility. Exotic pairs typically involve a major currency and a currency from a developing economy, presenting unique trading opportunities.

1.2 Leveraged Trading

One of the standout features of trading forex with Exness is the availability of high leverage options. This allows traders to control larger positions with a relatively smaller amount of capital. However, it’s essential to approach leveraged trading with caution and have an effective risk management strategy in place to safeguard your investments.

2. Commodities Trading Instruments

Commodities represent physical goods that can be traded on the market. Exness provides traders with the ability to trade various commodities, including precious metals, energies, and agricultural products. Commodities trading can serve as a hedge against inflation and provide diversification benefits for a trader’s portfolio.

2.1 Precious Metals

Gold and silver are among the most traded precious metals on Exness. Traders often turn to these metals during economic uncertainty, as they are considered safe-haven assets. The prices of precious metals can be influenced by various factors, including geopolitical tensions, currency fluctuations, and supply-demand dynamics.

2.2 Energies

Crude oil and natural gas are prominent energy commodities available for trading on Exness. These markets can be highly volatile, driven by factors such as geopolitical events, changes in production levels, and shifts in global demand.

3. Indices Trading Instruments

Indices represent a collection of stocks from various companies, reflecting the performance of a specific sector or market. Exness offers a range of indices, allowing traders to gain exposure to the overall market performance without needing to trade individual stocks.

3.1 Major Global Indices

Some of the most notable indices available for trading on Exness include the S&P 500, NASDAQ, FTSE 100, and DAX 30. Trading indices can be advantageous for traders looking for diversified exposure and reduced risk associated with trading a single stock.

3.2 Trading Strategies

Successful trading of indices often requires a different approach compared to trading individual stocks. Traders typically utilize technical analysis, market sentiment, and macroeconomic indicators to make informed decisions about index trades.

4. Cryptocurrencies Trading Instruments

The cryptocurrency market has gained significant popularity in recent years, and Exness offers traders the chance to indulge in this exciting and volatile asset class. From well-known cryptocurrencies like Bitcoin and Ethereum to altcoins, Exness provides a suite of options for crypto trading.

4.1 Volatility and Opportunities

Cryptocurrencies are known for their high volatility, which can present both risks and opportunities for traders. Exness allows traders to take advantage of price spikes and downtrends, but it is essential to be equipped with proper risk management techniques to navigate this landscape.

4.2 Leveraged Crypto Trading

Exness provides traders with the option of leveraged cryptocurrency trading, allowing them to amplify their exposure. However, as with forex, trading cryptocurrencies with leverage requires careful consideration and an understanding of the associated risks.

5. Conclusion

Exness offers a comprehensive range of trading instruments suited for both novice and experienced traders. With its impressive lineup of forex pairs, commodities, indices, and cryptocurrencies, traders can execute varied strategies tailored to their financial goals. Understanding how to leverage these instruments effectively is crucial for maximizing trading potential and navigating the complexities of the financial markets. Regardless of your chosen asset class, ensure that you stay informed and continuously enhance your trading knowledge.

By making the most of the resources and trading instruments offered by Exness, you can take confident steps toward your trading aspirations. Remember to use proper risk management techniques and keep abreast of market trends to build a cohesive trading strategy.